The first appeals to the Swiss Federal Supreme Court for delayed justice are on their way

On March 19, 2023, FINMA ordered the write-down of Credit Suisse’s AT1 bonds, causing investors to lose over CHF 16 billion. Between April and May 2023, approximately 2,500 investors filed around 230 appeals with the Swiss Federal Administrative Court against this decision. More than two years have passed since then, but the proceedings are inexplicably at a standstill. The court has taken no further procedural steps. Investors have not even received the responses from FINMA and Credit Suisse (now UBS) to their appeals, even though these entities filed their pleadings with the court some time ago, following what appears to be a deliberate (and ethically questionable) strategy of delay.

For more than two years, investors have also been waiting for a decision from the SFAC on their request for full access to FINMA’s files. This access is vital to ascertain if the write-down of Credit Suisse’s AT1 bonds was truly underpinned by valid economic and legal reasons. The lawyers involved in the proceedings are growing impatient. It is challenging for them to understand why the court is failing to forward to the plaintiffs the responses from FINMA and UBS that have been on its desk for some time, in some cases for almost two years.

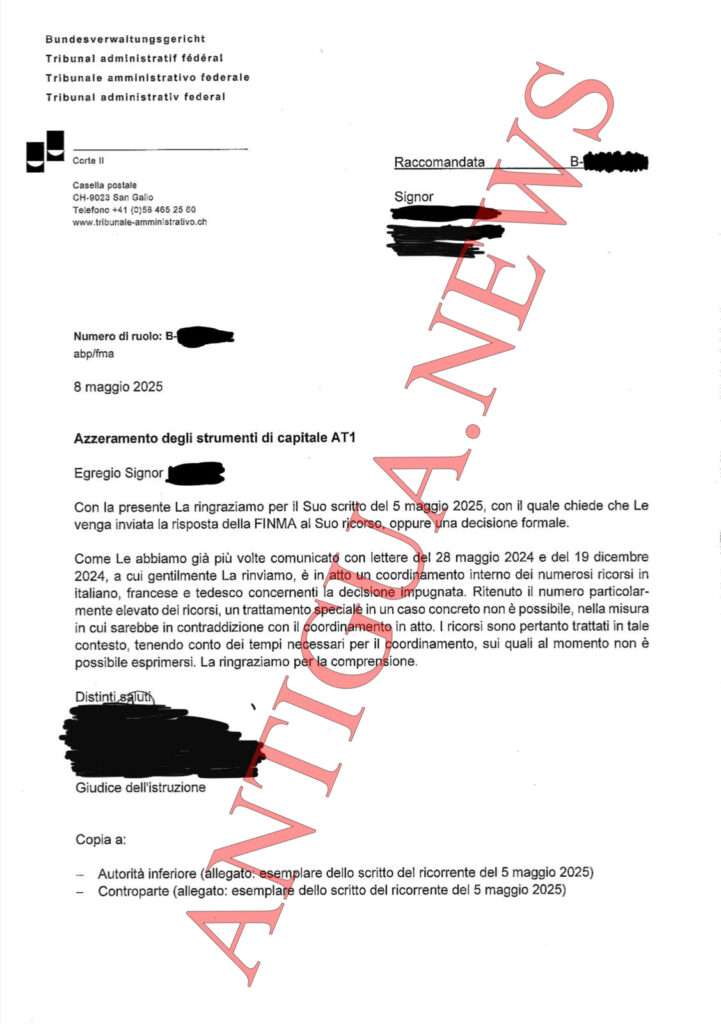

On April 20, 2025, the «Sonntagszeitung» reported the opinion of some observers who expect to receive a decision from the SFAC by the end of the year. Unfortunately, for the reasons outlined below, we are not so optimistic. The document published below reveals that one of the many lawyers defending the AT1 investors has been very diligent in pressing the court. On three occasions, he insisted that the court forward FINMA’s and UBS’s responses to him, warning on the last occasion that he would appeal to the Supreme Court for delay in justice if his request was refused again.

On all three occasions, the SFAC justified its refusal by using always the same argument, i.e. that “internal coordination is underway regarding the numerous appeals in Italian, French, and German concerning the contested decision”. In its latest response, the SFAC also added that: “The appeals are therefore being dealt with in this context, taking into account the time required for coordination, on which it is not possible to comment at this stage”.

More than two years after the appeals were filed, therefore, the SFAC has announced that not only has it not yet completed its “internal coordination,” but it does not even know when it will be completed. Not being perplexed by such vagueness after so much time is difficult. In particular, it is tough to imagine that such an essential and authoritative Swiss federal judicial body does not have the resources and capabilities necessary to coordinate 230 appeals, even over such a long period of time. Nor is it clear why the SFAC’s alleged internal organizational problems should weigh on the shoulders of the appellants, who have been crying out for justice for far too long.

It is even more difficult to justify this delay when one considers that the civil dispute brought by several thousand former Credit Suisse shareholders before the Zurich Commercial Court (in which it is being contested the exchange value between CS and UBS shares following the merger) is at a much more advanced stage. Two exchanges of written pleadings have already taken place before the cantonal court; the plaintiffs have recently received UBS’s rejoinder of approximately seven hundred pages and, barring further exchanges of submissions, they are preparing to enter the preliminary investigation phase.

Art. 29(1) of the Swiss Federal Constitution says: “Every person has the right to equal and fair treatment in judicial and administrative proceedings and to have their case decided within a reasonable time“. Is waiting over two years from the SFAC to receive FINMA and UBS’s response a reasonable amount of time? Many lawyers involved in AT1 case are asking themselves this question.

What is certain is that, given the circumstances, it seems rather unlikely that the SFAC will decide on the merits of the appeals this year. It is much more plausible that the Zurich Commercial Court will first reach a decision on the fate of the former Credit Suisse shareholders, or by other foreign courts. Barring any surprises, of course. The lawyer who has pressed the SFAC three times in vain for receiving copies of the responses from FINMA and UBS has already announced that he will file an appeal for delayed justice with the Swiss Federal Supreme Court. Others are moving in the same direction, according to information obtained by «Antigua.news». Therefore, it will be up to the Supreme Court to decide whether waiting more than two years for an “internal coordination” of 230 appeals is too long.

In the meantime, thanks to the «Sonntagszeitung» (article published on May 4, 2025), new documents have emerged from the aforementioned civil case pending before the Zurich Commercial Court. In particular, the contents of a pivotal letter sent on March 15, 2023, by Axel Lehmann (former CS chairman) to Thomas Jordan (former Swiss National Bank president) alongside four additional emails have been made public, confirming the massive falsehoods told by the CS officers to the detriment of investors. As we have already reported in the past, on March 15, 2023, during a Financial Sector Conference in Riyadh, Axel Lehmann stated that Credit Suisse had already “taken its medicine” and had been “significantly de-risking its balance sheet” for more than five months, and was essentially ahead of the curve in dealing with potential liquidity issues. Regarding the possibility of accepting the government assistance, Lehmann stated unequivocally: “That’s not a topic. Look, we are regulated, we have a strong capital ratio, a very strong balance sheet, we are all hands on deck, so that’s not a topic whatsoever”.

The harsh truth, howeve