The Swiss Supreme Court has ordered the Swiss Federal Administrative Court to explain the delays in processing the appeals

There has been a development regarding the write-down of Credit Suisse’s AT1 bonds. Following complaints from certain investors about delayed justice — an issue first reported by Antigua.news on May 24, 2025 — the Swiss Supreme Court has delivered a significant initial ruling.

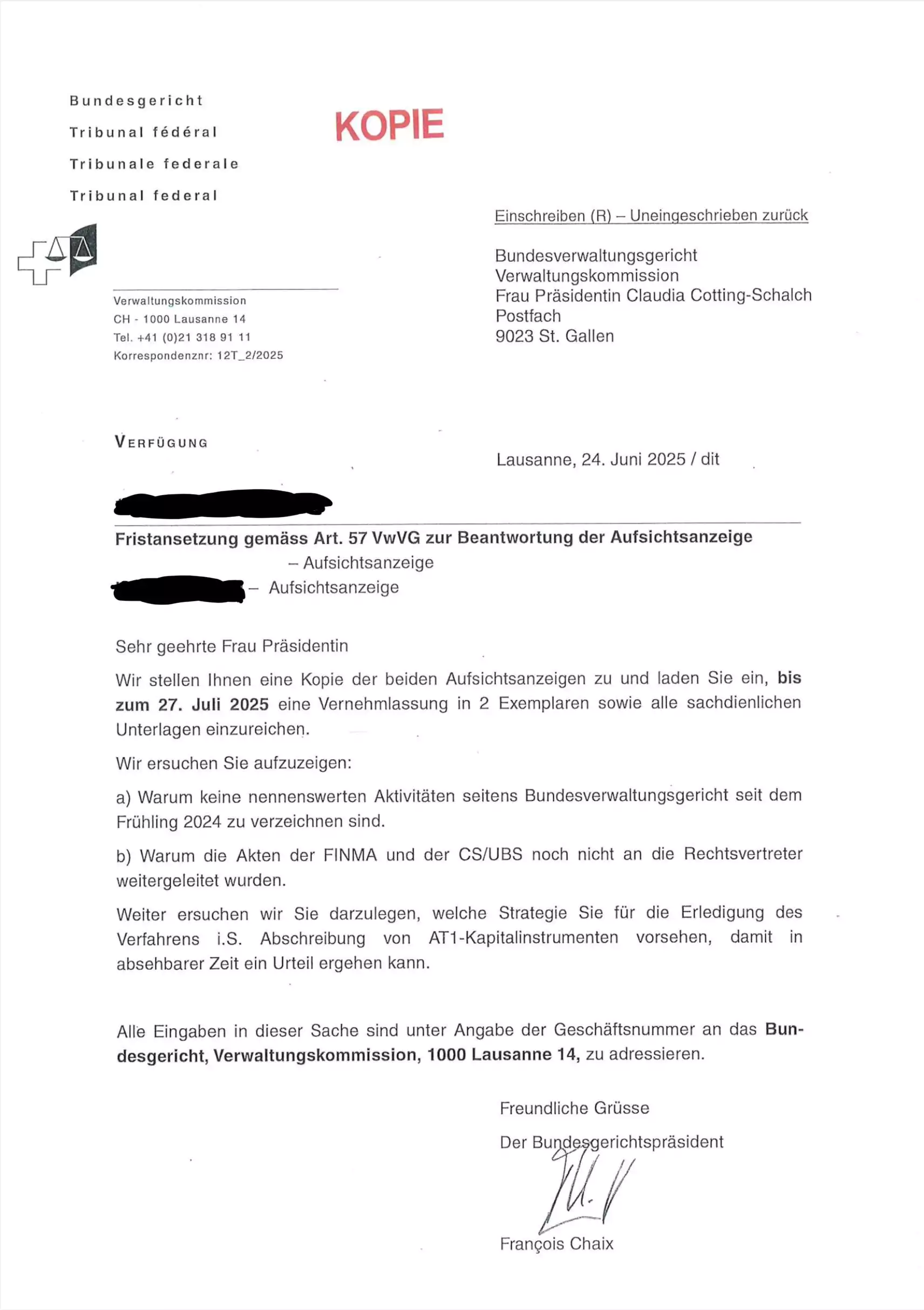

In an order dated June 24, 2025, the Swiss Supreme Court, acting as supervisory authority, instructed the Swiss Federal Administrative Court (SFAC) to respond to the investors’ complaints by July 27, 2025. The Court also issued specific questions for SFAC, requesting detailed explanations:

1. Why has no significant progress been recorded at the SFAC since spring 2024?

2. Why have the files of FINMA and CS/UBS not yet been transmitted to the legal representatives?

Additionally, the Swiss Supreme Court asked the SFAC to clarify its “strategy for completing the proceedings regarding the write-down of AT1 capital instruments so that a ruling can be issued in the foreseeable future.”

The message is clear: the Swiss Supreme Court acknowledges the investors’ concerns about an anomalous delay and expects concrete, non-evasive answers from SFAC.

When investors call, the Swiss Supreme Court responds — at least for now.